Business Structuring - Why Tax Shouldn't Be The Main Driver

- Navneel Lal

- Jan 12, 2022

- 2 min read

Updated: Oct 10, 2022

ASF TAKEAWAYS: When it comes to business structuring advice, there is no one-size-fits-all solution. It is important that business structures are continuously evaluated for appropriateness to the prevailing economic, taxation and personal circumstances.

Before a client embarks on any new venture - starting a new business, diversifying into a new business line or acquiring new assets, one of the most important decisions that needs to be made is how to structure this venture. Many clients do not appreciate or understand the importance of choosing the right structure, as invariably, this choice dictates how the business will generate wealth for the operator, how it will distribute said wealth and the implications on exiting the business. Unfortunately, tax appears to be the key driver behind why business is structured the way it is at the start of its journey. Rectification to the business structure post the initial implementation could have tax implications, chiefly capital gains or state taxes, although certain rollover reliefs can be sought.

In this blog, I cover the various other considerations that should be of equal importance to tax when commencing a new venture, and explain why we, at ASF, undertake a structure review at the first instance for any new clients.

A good adviser takes into account the clients personal and business goals and objectives, and ask the five pertinent questions;

- is asset protection a priority?

- will you be working alone, or will the business have multiple owners?

- what are the tax implications?

- how to optimise the total amount of tax your family pays?

- Does the regulation in your industry or profession affect the structures that you can use?

After considering each factor, the best structure is derived from a balance of weighting applied to each element.

One thing is certain - continual review is key. It is important to constantly evaluate the business structure for appropriateness to the prevailing economic, taxation and personal circumstances.

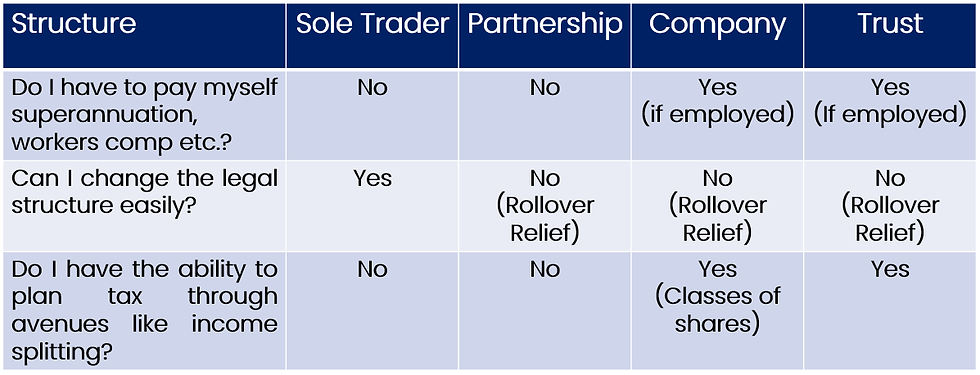

Each business structure comes with its own advantages and disadvantages, and options range from sole traders, trusts, companies and partnerships. These can be summarised as follows;

Initial setup and control

Asset protection and access to funds

Tax implications and income splitting

Access to capital and exit strategies

What are the most common business structuring errors we see with new clients?

In our experience, we tend to see the errors gravitate toward the following six areas:

1) Operating as a Sole Trader or Partnership while holding substantial assets like the family home in the business operator's name(s).

2) Trading as a Company when the company shares are held individually by the Husband and Wife.

3) Operating all of your businesses or owning all of your business/personal assets under one entity.

4) Operating as a Sole Trader or Partnership whilst other family members are earning lower income than you.

5) Purchasing investment properties or other potentially high growth capital assets under a Company structure.

6) Operating as a Sole Trader or Partnership and having no consideration for your succession or estate planning options.

When it comes to business structuring advice, there is no one-size-fits-all solution.

Furthermore, whilst upmost care is taken to fully understand your specific circumstances to ensure the ideal structure and outcomes for your business, the business structure must continue to be reviewed for the prevailing family and business dynamics.

The team at ASF pride ourselves at providing real solutions when it comes to business structuring. We are happy to assist in any way.

Comments